Tasty Dominican & Latin-Inspired Recipes - My Dominican Kitchen

Get Cooking

Meet Vanessa

¡Hola! I’m Vanessa, award-winning food photographer, nationally recognized content creator, and founder of My Dominican Kitchen®. Here you’ll find authentic traditional Dominican recipes and tasty Latin-inspired dishes for home cooks.

Learn More

Dominican Recipes

Dominican food is rich and hearty, with influences from Spanish, indigenous Taíno, Middle-Eastern and African cuisines. These authentic recipes are loaded with flavor, and I’m sure that you and your family will love them.

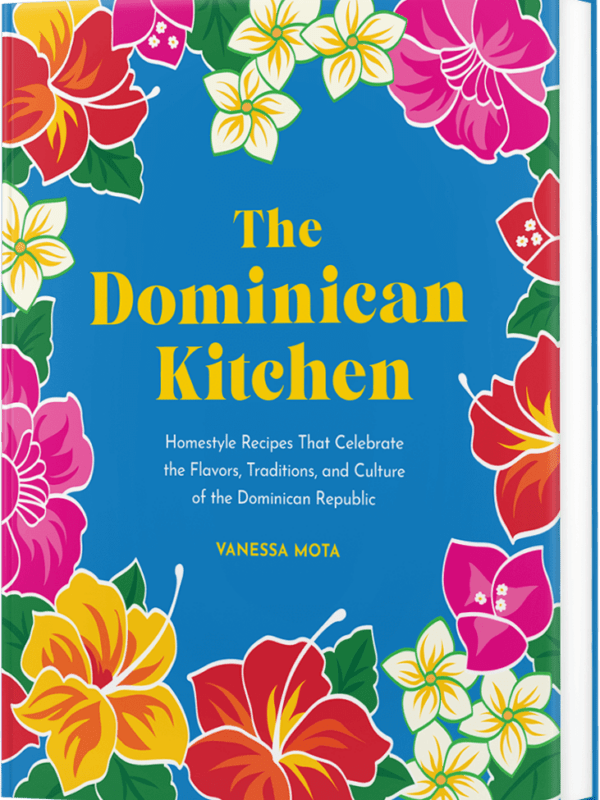

The Dominican Kitchen is a collection of 80+ authentic recipes created with easy-to-find ingredients and featuring comforting traditional Dominican flavors. Check out our cookbook page for more details.

Buy Now

Get the latest recipes delivered to your inbox!

Latest Video

Learn how to peel plantains, quickly and easily, with this video. Plantains are a staple in Dominican cooking. Enjoy this Caribbean favorite in so many dishes or as a delicious snack.

Explore Our Recipes

Browse our collection of authentic, traditional Dominican recipes and some tasty Latin-inspired dishes. Here you’ll find hundreds of easy and flavorful recipes to cook at home.